Union Finance Minister Nirmala Sitharaman will present the budget for FY 2025-26 today at 11 am. The Indian middle class and taxpayers are hoping that this budget might bring about some major income-tax-related breaks and reliefs for them.

Union Budget 2025-26:

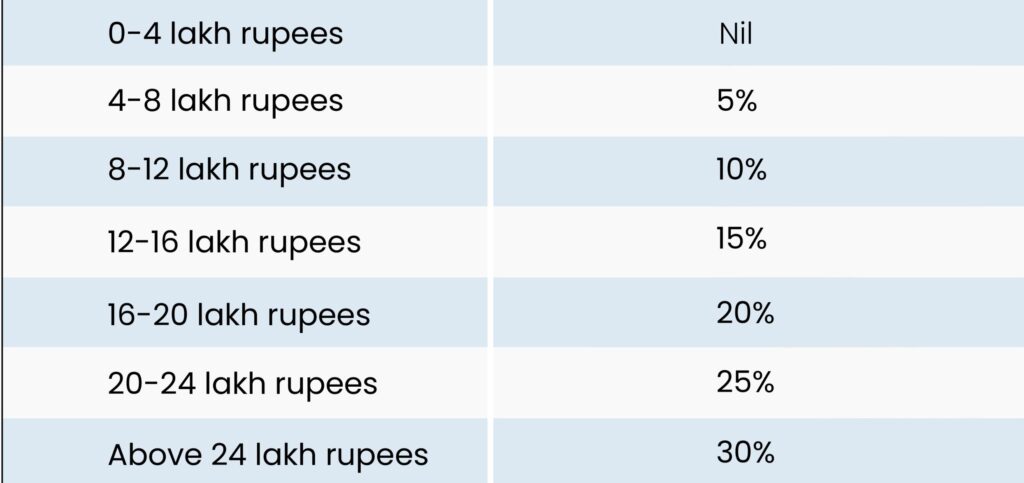

Zero Income Tax till ₹12 Lakh Income under New Tax Regime

No income tax will be paid on income up to Rs 12 lakh, and no tax on income up to Rs 12.75 lakh for salaried people, due to the standard deduction of Rs 75,000.Nirmala Sitharaman announced in the budget.

Earlier, she had said that he will present a new income tax bill next week. she said that income tax reforms have been made with the middle class in mind. Emphasis has been placed on simplifying TCS and TDS.

The entire income tax structure is changing. The announcement by the Union Finance Minister Nirmala Sitaraman. The new income tax bill is coming next week. In this atmosphere, everyone is watching what changes will be made in the income tax structure.

Budget 2025-26:Foreign investment in the insurance sector is increasing

Foreign investment in the insurance sector has increased. The Union Finance Minister has proposed to increase FDI in insurance from 74 percent to 100 percent.

.

Importing Drugs / Medicines Becomes Cheaper

Full tax waiver on 36 life-saving drugs, including cancer drugs

Announcement by the Union Finance Minister

Tax exemptions increased for senior citizens

New income tax bill to be brought next week, tax exemption for senior citizens to be increased from Rs 50,000 to Rs 1 lakh. TDS deduction on house rent increased from Rs 4 lakh to Rs 6 lakh. TCS increased from Rs 7 lakh to Rs 10 lakh. Said Nirmala Sitharaman.

.

Budget 2025-26:Prices of TVs, mobiles, electric vehicle batteries are falling.

Prices of TVs, mobiles, electric vehicle batteries are falling. Leather goods, frozen fish will be cheaper. Union Finance Minister announced in the budget.

IITs are set to get an infrastructure push

The capacity of IITs will be enhanced. In the last 10 years, the total number of students in 23 IITs has increased by 100% from 65,000 to 1.35 lakh. Additional infrastructure will be created in five IITs started after 2014 and IIT Patna will also be expanded. IIT Palakkad, Goa, Bhilai, Jammu, Dharwad and Tirupati were established after 2014.

‘10,000 fellowships with more financial support will be provided in the next five years under the PM Research Fellowship Scheme for technology research in IITs and IISc.’

.

Budget 2025-26:Thousands of seats will be added to medical colleges

10,000 additional seats will be added to medical colleges next year. The target is 75,000 seats in the next 5 years. The Finance Minister said the goal is to build cancer hospitals in every district hospital.

.

Prime Minister Dhan-Dhaanya Krishi Yojana: Developing Agri Districts Programme

The Center is going to prepare the Pradhan Mantri Dhan-Dhanya Krishi Yojana in coordination with various states. About 1.7 crore farmers will benefit from this scheme.

.

Budget 2025-26:Kisan Credit Card loan limit now 5 lakhs

Loan amount on Kisan Credit Card increased from Rs 3 lakh to Rs 5 lakh

The Union Finance Minister announced that the loan amount under Kisan Credit Card will be increased from Rs 3 lakh to Rs 5 lakh.

.

Kisan Credit Card

— PIB India (@PIB_India) February 1, 2025

-Facilitate short-term loans for 7.7 Crore farmers, fishermen & dairy farmers

-The loan limit under the Modified Interest Subvention Scheme will be enhanced from ₹3 Lakh to ₹5 Lakh for loans taken through KCC

-Union Finance Minister @nsitharaman… pic.twitter.com/nkOIcjb1DV

Budget 2025-26:Nirmala Sitharaman wears Madhubani saree, pours out budget allocation for Bihar

Makhana Board to be set up in Bihar. The board will provide training and support to Makhana farmers. The Finance Minister announced the establishment of a National Institute of Food Technology in Bihar in the Union Budget. He said, “We will set up a National Institute of Food Technology in Bihar, which will boost food processing in eastern India. It will create employment for the youth.”

.

Budget 2025-26:Jal Jeevan Mission extended till 2028

Union finance minister Nirmala Sitharaman said that the jal jeevan mission, which seeks to provide tap water connections to all rural households, has been extended until 2028.

Budget 2025-26:Indirect Tax Measures for Trade Facilitation

Time-limit of two years to be fixed, extendable by a year, for finalizing provisional assessment under the Customs Act

Incentivizing Voluntary Compliance: New provision to be introduced which will enable importers or exporters, after clearance of goods, to voluntarily declare material facts and pay duty with interest but without penalty

Budget 2025-26:Tax Reforms to Promote Investment and Employment

NRIs who provide services to a resident company that is establishing or operating an electronics manufacturing facility, to benefit from a presumptive taxation regime

Period of incorporation to be extended by 5 years to allow tax benefits to startups incorporated before 1.4.2030

.

Budget 2025-26:Special Economic Zone for Fishermen

‘The Centre will work hand in hand with the states for development, a Special Economic Zone will be created for fishermen’ said Nirmala Sitharaman.