Finance Minister Nirmala Sitharaman in her Union Budget 2025 speech announced sweeping changes in personal income tax, with major revamp of income tax slabs and income tax rates under the new income tax regime.

Income Tax Update :

Finance Minister Nirmala Sitharaman has announced that there will be no income tax for income up to Rs 12 lakh. This is a big boon for salaried employees.

Finance Minister Nirmala Sitharaman said, “My tax proposals are aimed at improving the ease of doing business, encouraging voluntary compliance and reducing the overall compliance burden. These proposals will focus on personal income tax reforms, especially benefiting the middle class, addressing challenges by simplifying TDS and TCS, and providing incentives for employment and investment growth.”

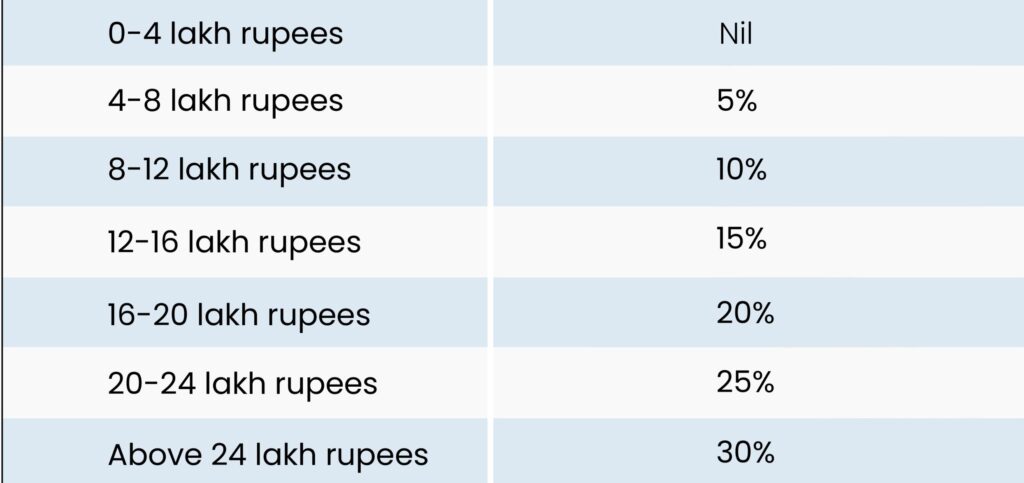

Here are the latest income tax slabs and rates for FY 2025-26

Rs: 0-4 lakh – Nil

Rs: 4-8 lakh- 5%

Rs: 8-12 lakh- 10%

Rs: 12-16 lakh- 15%

Rs: 16-20 lakh-20%

Rs: 20-24 lakh- 25%

Above Rs: 24 lakh- 30%

.

Income Tax Slabs 2025 Live:

- Annual earnings up to Rs 2,50,000 are exempt from taxation

- 5% tax applies on earnings between Rs 2,50,001 and Rs 5,00,000

- 20% tax rate for income range of Rs 5,00,001 to Rs 10,00,000

- Earnings exceeding Rs 10,00,000 are taxed at 30%

What is the amount of tax relief you will get?

Here are some of the benefits:

In addition to the slab rate reduction, general taxpayers with income up to Rs 12 lakh are also being given tax exemptions so that they do not have to pay any tax.

Under the new system, a taxpayer with an income of Rs 12 lakh will get a tax benefit of Rs 80,000.

A person with an income of Rs 18 lakh will get a tax benefit of Rs 70,000 (30% of the tax payable as per the existing rate).

A person with an income of Rs 25 lakh will get a benefit of Rs 1,10,000 (25% of the tax payable as per the existing rate).

.

Highly beneficial for the middle class and senior citizens’

Overall, this budget is very beneficial for the middle class and senior citizens. The increase in TCS limit from ₹7 lakh to ₹10 lakh and the doubling of TDS limit for senior citizens provide significant relief. also, with no income tax up to ₹12 lakh, disposable income will increase, which will in turn increase expenditure and economic growth. These measures will not only support the middle class and industry but will also make this a balanced budget,” said Meghna Mishra, Senior Partner, Karanjawala & Co.

Benefit for two self-occupied properties

Considering the difficulties faced by taxpayers due to certain conditions of self-occupied properties, it is proposed to allow the benefit of two such self-occupied properties without any conditions.